Why we invested in one • fıve — a startup reimagining sustainable packaging products

September 28, 2022

one.five 🇩🇪 is transforming dormant material science inventions into packaging products for the conscious consumer. They are building a biomaterials discovery and scale-up platform that will equip companies with solutions to make their product lines truly circular.

The one.five team

Have you ever thought about how much packaging we use in one day?

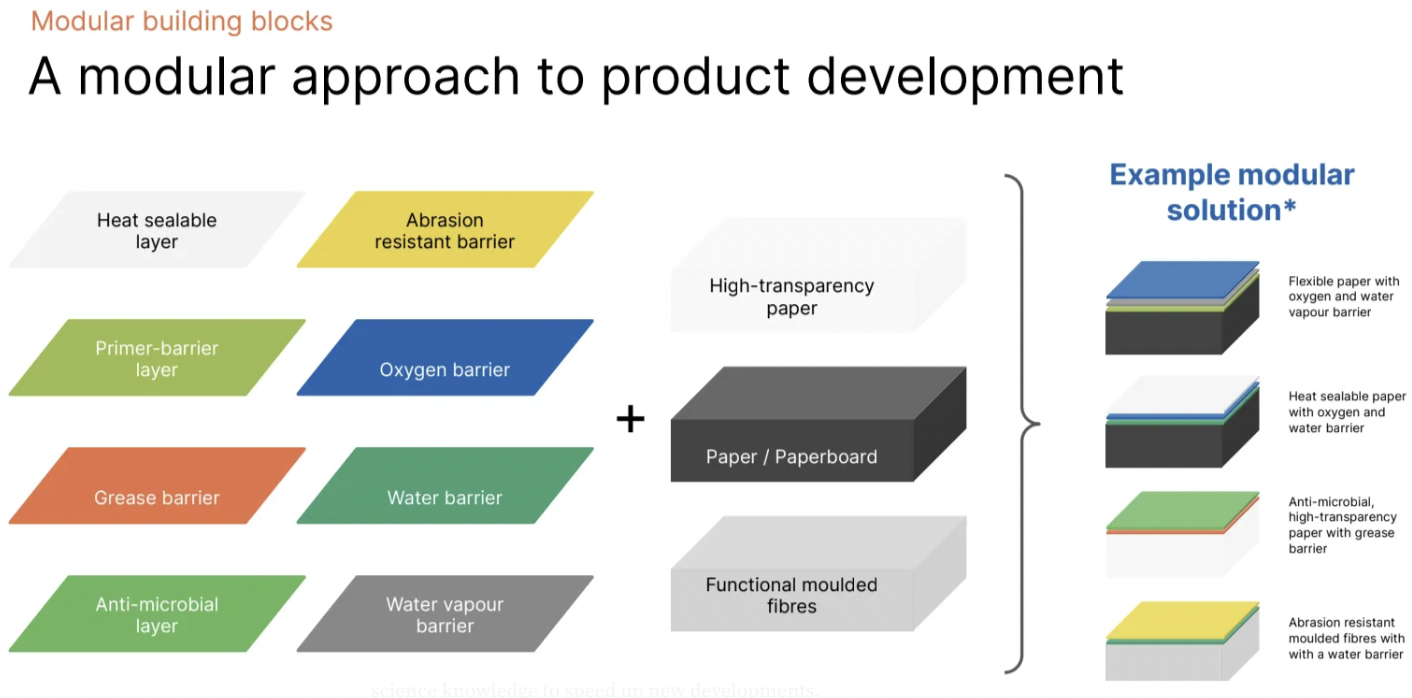

Polyethylene terephthalate (PET) and other plastic packaging — which you recognize in water bottles, salad containers, etc. — is often the easiest and cheapest solution to pack consumer goods. It’s also effective since plastic fulfills many important criteria such as heat sealability (creates a closed container for the core product), oxygen and water barrier (protects the core product from the external environment), abrasion resistance (protects the packaging material from damage caused in transit) and so on.

However, conventional plastics contribute about 4.5% of global greenhouse gas (GHG) emissions (World Economic Forum, 2021) — not to mention the numerous negative impacts on human health and biodiversity (more on that here).

That’s why we’re so excited to invest in one.five. They are bridging the gap between research and commercialization to bring more sustainable alternatives to conventional plastics into the market. Ultimately, replacing pollutive packaging with cleaner solutions for the biggest consumer goods companies in the world.

There is no one solution to replace all the functionalities of plastic as mentioned above, and so a modular approach is needed — in other words, the packaging must combine different functional layers to fulfill the needs of different products. For example, an oxygen barrier is critical for ketchup, but not so much for pasta. See below:

One of one.five’s first products — a substitute for sauce packets (like ketchup) — could generate 76% fewer carbon emissions in terms of packaging production and raw material extraction than the current multi-layer PET-based alternative. (Hat tip to our friends at Planet A Ventures for their thorough life-cycle analysis!)

You may ask: why hasn’t this problem been solved yet?

One reason it hasn’t is: designing materials for circularity is a relatively new discipline. The industry’s reliance on petro-chemicals makes pivoting to bio-based alternatives complex and few internal R&D teams have mastered the challenge. Even fewer have the budget to spare for these new initiatives.

All of that is not for a lack of desire, since functional and sustainable packaging is becoming an important differentiator in many product categories as consumers become more discerning.

Where does one.five fit in?

one.five is pioneering a modular approach in which they identify the requirements of FMCG players and pair them with dormant material solutions.

Aspects of packaging innovation already exist, but they’re often buried in unused intellectual property (IP) of scientists and academic researchers. one.five’s solution uses computational power to mine the entirety of material science knowledge to speed up new developments.

This knowledge is powerful when combined with the application know-how to bring it from lab to commercial scale. That’s why one.five has built up a campus near Hamburg to provide testing, scaling, and application support.

In other words, one.five is the only asset-light packaging solutions platform in Europe with an advanced discovery engine and its own scale-up capacity.

one.five founders (Martin and Claire)

The founding team comes from Infarm, where they helped the startup grow into a unicorn. They have already assembled a diverse team, and their strong relations with the FMCG and packaging industry set them up for success. We are thrilled to join Martin and Claire on their mission to pioneer next-gen eco-saving materials. We’re also excited to team up with our friends Planet A Ventures, Green Generation Fund, Speedinvest, and Revent on this deal.

About Climentum Capital

Climentum Capital is a Venture Capital firm based in Copenhagen, Berlin, and Stockholm. We invest in European startups that can cut down megatons of CO2 emissions in a concrete and measurable way. The fund targets late Seed and Series A investments into the six sectors that demonstrate the largest CO2 reduction potential: Industry & Manufacturing, NextGen Renewables, Food & Agriculture, Buildings & Architecture, Transportation & Mobility, and Waste & Materials.

As one of the first Venture Capital funds with a double carry structure (with both financial and impact targets), Climentum is dedicated from day one to evaluating and only investing in companies that hold true carbon reduction potential.